(This post was originally published on October 23rd, 2013. We’ve updated it for accuracy and completeness.)

All merchants deal with the challenge of managing the data that their operations generate. You must pull orders, update item information, update inventory counts, create invoices, and enter payments into your accounting systems.

If you’re quickly growing or sell across multiple channels, then tracking down data takes most of your time and many hands to do. If not managed correctly, manually moving data between systems can be costly and counterproductive. That’s why many merchants turn to integrating their accounting system.

In this article, we’ll talk about the benefits of accounting integration and the best way to approach it.

Benefits of an Integrated Accounting System

It usually doesn’t take too long before merchants become fed up with the time and effort involved in manually keying sales data into your accounting system. With today’s technology advancement, you would assume that there must be a faster way to move this data automatically. And, there is!

Accounting integration moves data electronically between the systems that help you manage your sales processes. The main benefits of automating these processes are:

- Reduce errors in data from typos or miscommunication

- Reduce overhead costs

- Save time

- Improve customer experience

When you integrate, your customers benefit the most. Shipping addresses are entered correctly to ensure packages are delivered on time. Real-time inventory counts are displayed so you don’t oversell. Product information is consistent and accurate giving customers the confidence to buy. In short, customers can trust to do business with you.

While integration is sure to help merchants, it can be tough to find the right solution and partner for your business. The best integration approach can depend on whom you sell to, what systems you have in place, and your operational procedures.

Challenges of Accounting Integration

Integration is not a “one size fits all” kind of project. Of course, there are a lot of technology options to help you physically move data, but the type of data also matters. In some scenarios, a company may need a great deal of transactional detail to feed into their back-end systems. Other times, summary data is enough. The trick is finding the right approach to help you reach your business goals.

A quick self-evaluation will help you figure out the best approach for your integration project. At the most basic level, if you are a pure retailer that sells to consumers through physical stores and eCommerce channels, then general ledger integration is typically the right approach. If your company sells to consumers through B2C channels but also sells to B2B accounts (like wholesalers), transaction-based integration may be a better choice.

How to Integrate Your Accounting Systems

To more easily apply this theory to your business, let’s take a closer look at both of these options using the following data as an example:

General Ledger Integration

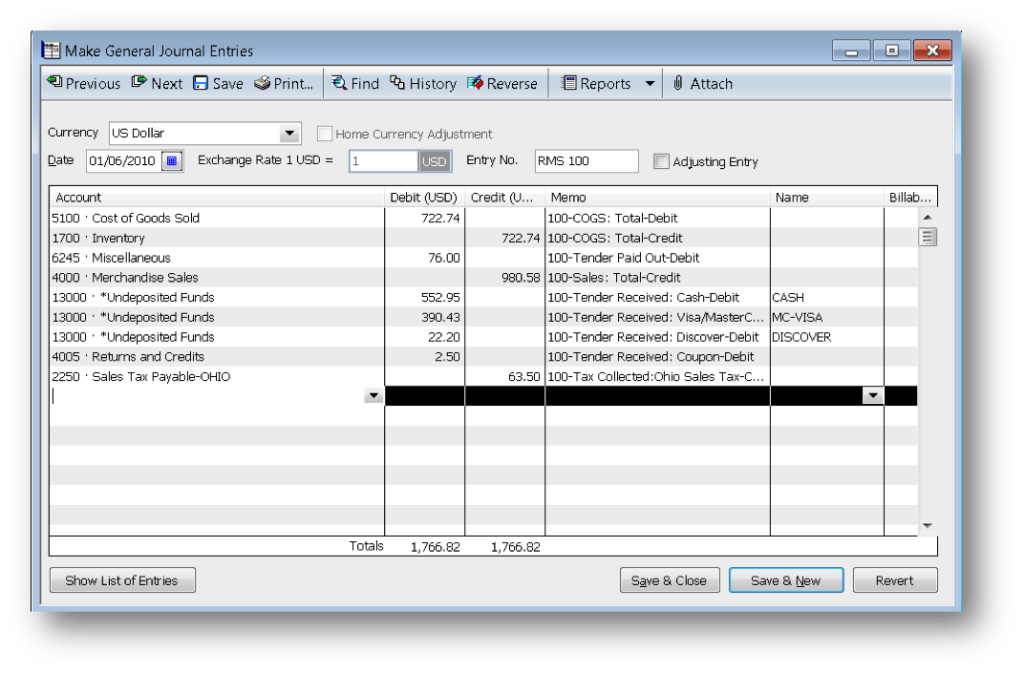

General ledger integration is used when a company only needs to capture relevant summary data from a sheer dollars and cents standpoint. If you are a pure retailer who typically manages item, inventory, supplier, and customer data in a point-of-sale (POS) system, a journal entry into your accounting system is all you need to capture sales, cost of sales, sales tax collected, and cash receipts.

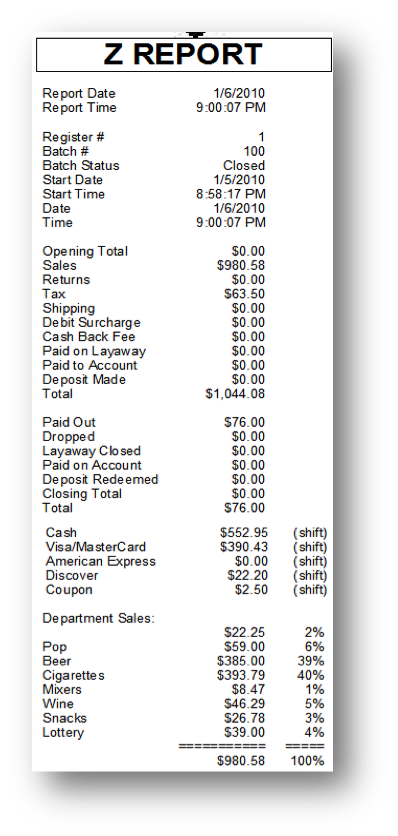

With general ledger integration, this journal entry is made electronically by transferring the summary data from a Z Report generated by the POS system to the accounting system. This automation serves as a great time saver since you no longer have to dedicate resources to the tedious task of hand keying the data.

Transactional Integration

In most cases, companies that sell to both B2B and B2C customers use an ERP system to manage their business. The ERP becomes the foundation for all item, inventory, supplier, and customer and customer data. Retailers create items here and then publish them to other systems, such as POS, eCommerce, and B2B ordering systems. When you designate a system as the foundation for your data, it becomes the master of data.

Transactional integration, then, is the process of capturing sales data from multiple channels via a transaction that is created in the system where the data is mastered. Transactional integration differs from Z Report general ledger integration because actual sales transactions are created in the ERP system. Sometimes this is done for every individual sales transaction while others create one sales transaction for each Z Report that includes every item sold for that day.

With transactional integration, you can capture both sales and inventory data in your ERP. This provides complete visibility into your inventory levels in a single system. No longer do you need to compile inventory data from all of your sales systems before making purchasing decisions. Additionally, transaction level integration also enables inventory transfers between warehouses and stores, inter-store transfers, and purchase order and inventory receipt transactions to flow between ERP and POS systems.

Choosing an Accounting Integration Solution

Trying to fit your processes into the confines of a technology solution is always a difficult task. But, the right solution and partner can make it work.

To see how accounting integration can work, check out how nChannel can help with their multichannel management platform.

Accounting integration is just one part of your multichannel business and strategy. Check out other insights about retail integration.

- 10 Signs That You Need Multichannel Retail Integration

- 10 Common Mistakes Retailers That Make or Kill Their Multichannel Selling Success

- 5 Business Practices That Make or Break Your Multichannel Strategy

- eCommerce POS Integration: Why Integrate Your Systems

Join The Conversation